take home pay calculator maine

You must report that money as income on your 2019 tax return. This calculator is intended for use by US.

Maine Income Tax Calculator Smartasset

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Maine.

. The taxes you will have to pay in order to receive. For this a tax calculator is an essential. If you make 55000 a year living in the region of New York USA you will be taxed 12213That means that your net pay will be 42787 per year or 3566 per month.

Calculate your Maine net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Maine paycheck calculator. This salary calculation is based on an annual salary of 4000000 when filing an annual income tax return in Maine lets take a look at how we calculated the various payroll and incme tax deductions. It can also be used to help fill steps 3 and 4 of a W-4 form.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. The Omicron variant has. This varies across states and can range from 0 to more than 8.

Salary paycheck calculator guide. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Maine Cigarette Tax.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Maine. Calculates Federal FICA Medicare and withholding taxes for all 50 states. For example lets say you elected to receive your lottery winnings in the form of annuity payments and received 50000 in 2019.

2 days agoIf your idea of a perfect Valentines Day outing includes being wined and dined by a beloved fast-food chain you may be out of luck. How to calculate net income. While this calculator can be used for Maine tax calculations by using the drop down menu provided you are able to change it to a different State.

Alternatively use the Maine State Salary Calculator and alter the filing status number of children and other taxation and payroll. Maine Hourly Paycheck and Payroll Calculator. This free easy to use payroll calculator will calculate your take home pay.

This Maine hourly paycheck calculator is perfect for those who are paid on an hourly basis. How to Calculate Federal Tax and State Tax in Maine in. If you are in a rush or simply wish to browse different salaries in Maine to get an idea of how Federal and State taxes affect take home pay you can select one of our pre-built salary example for Maine below.

Maine Salary Paycheck Calculator. Buy a Lottery ticket now. If you buy cigarettes in Maine youll have to pay the states cigarette tax.

Maine State Unemployment Insurance SUI As an employer in Maine you have to pay unemployment insurance to the state. If youre a new employer congratulations you pay a flat rate of 231. Income tax withheld by the US government including income from lottery prize money.

Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers. Need help calculating paychecks. Supports hourly salary income and multiple pay frequencies.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. Maine is an alcoholic beverage control state meaning the states Bureau of Alcoholic Beverages and Lottery Operations controls the wholesale of liquor and fortified wines within the state. Your average tax rate is 222 and your marginal tax rate is 361This marginal tax rate means that your immediate additional income will be taxed at this rate.

The calculation is based on the 2021 tax brackets and the new W-4 which in. Determine taxable income by deducting any pre-tax contributions to benefits. Additional tax withheld dependent on the state.

That means you could take home 220000 if you sell your home for 313134 and pay 106 to sell it. The same is true however if you take a lump-sum payout in 2019. But you may owe money on the property the average Maine homeowner still owes 140904.

The rate ranges from 049 to 581 on the first 12000 in wages paid to each employee in a calendar year. This can range from 24 to 37 of your winnings. It adds up to 200 per pack.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. You must report that entire amount as well. To use our Maine Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. After a few seconds you will be provided with a full breakdown of the tax you are paying. If you do your remaining mortgage balance will come out of your proceeds cutting into the amount that will finally land in your bank account.

Our Maine State Tax Calculator will display a detailed graphical breakdown of the percentage and amounts which will be taken from your 6000000 and go towards tax. Although our salary paycheck calculator does much of the heavy lifting it may be helpful to take a closer look at a few of the calculations that are essential to payroll.

Big News Home Mortgage Mortgage Blue Stripes

Seafood Restaurant Oyster Bar In Portland Maine Boone S Fish House Oyster Room Fish House Seafood Restaurant Oyster Bar

The Financial Diet Joanne S Career Checkup Note To Self Checkup Finance

404 Error Page Not Found Ballston Virginia Shopping Fun

Maine Sales Tax Small Business Guide Truic

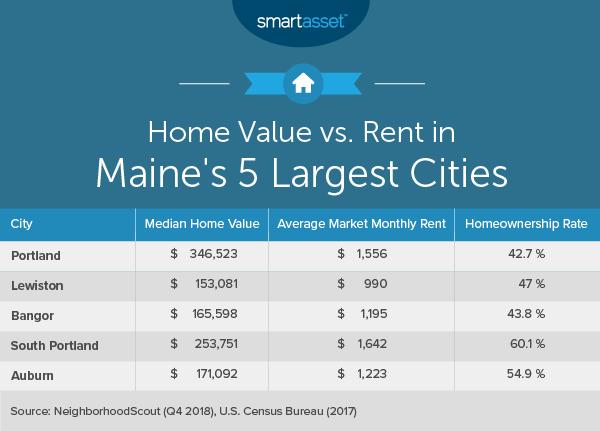

What Is The Cost Of Living In Maine Smartasset